mississippi income tax brackets

W-4 Pro - Tax Return Based W-4 Form. Ad Compare Your 2022 Tax Bracket vs.

Mississippi Income Tax Brackets 2020

W-4 Adjust - W-4 Form Tax Return Based.

. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Mississippi income tax rates the state has a simple progressive tax rate with only three tax brackets for all taxpayers. Mississippi one of the poorest states in the nation has struggling rural hospitals and perpetually underfunded schools.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The state income tax system in Mississippi is a progressive tax system. Tax rate of 4 on taxable income between 5001 and 10000. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

What is the Single Income Tax Filing Type. Ad See If You Qualify To File State And Federal For Free With TurboTax Free Edition. The latest available tax rates are for 2020 and the Mississippi income tax brackets have not been changed since 2019.

Tax rate of 5 on taxable income over 10000. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. The 5 tax on income over 4000 will also be reduced to 47.

Explore The Top 2 of On-Demand Finance Pros. Any income over 10000 would be taxes at the highest rate of 5. Tax rate of 0 on the first 5000 of taxable income.

The Mississippi State Tax Tables below are a snapshot of the tax rates and thresholds in Mississippi they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Mississippi Department of Revenue website. All other income tax returns P. Unlike the Federal Income Tax Mississippis state income tax does not provide couples filing jointly with expanded income tax brackets.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. 0 on the first 2000 of taxable income 3 on the next 3000 of taxable income 4 on the next 5000 of taxable income 5 on all taxable income over 10000 More Help With Taxes in Mississippi. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Tax Bracket Tax Rate. Then two years. If you are receiving a refund PO.

5 on all taxable income over 10000. The tax brackets are the same for all filing statuses. Any income over 10000 would be taxes at the highest rate of 5.

The chart below breaks down the Mississippi tax brackets using this model. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Notably Mississippi has the highest maximum marginal tax bracket in the United States.

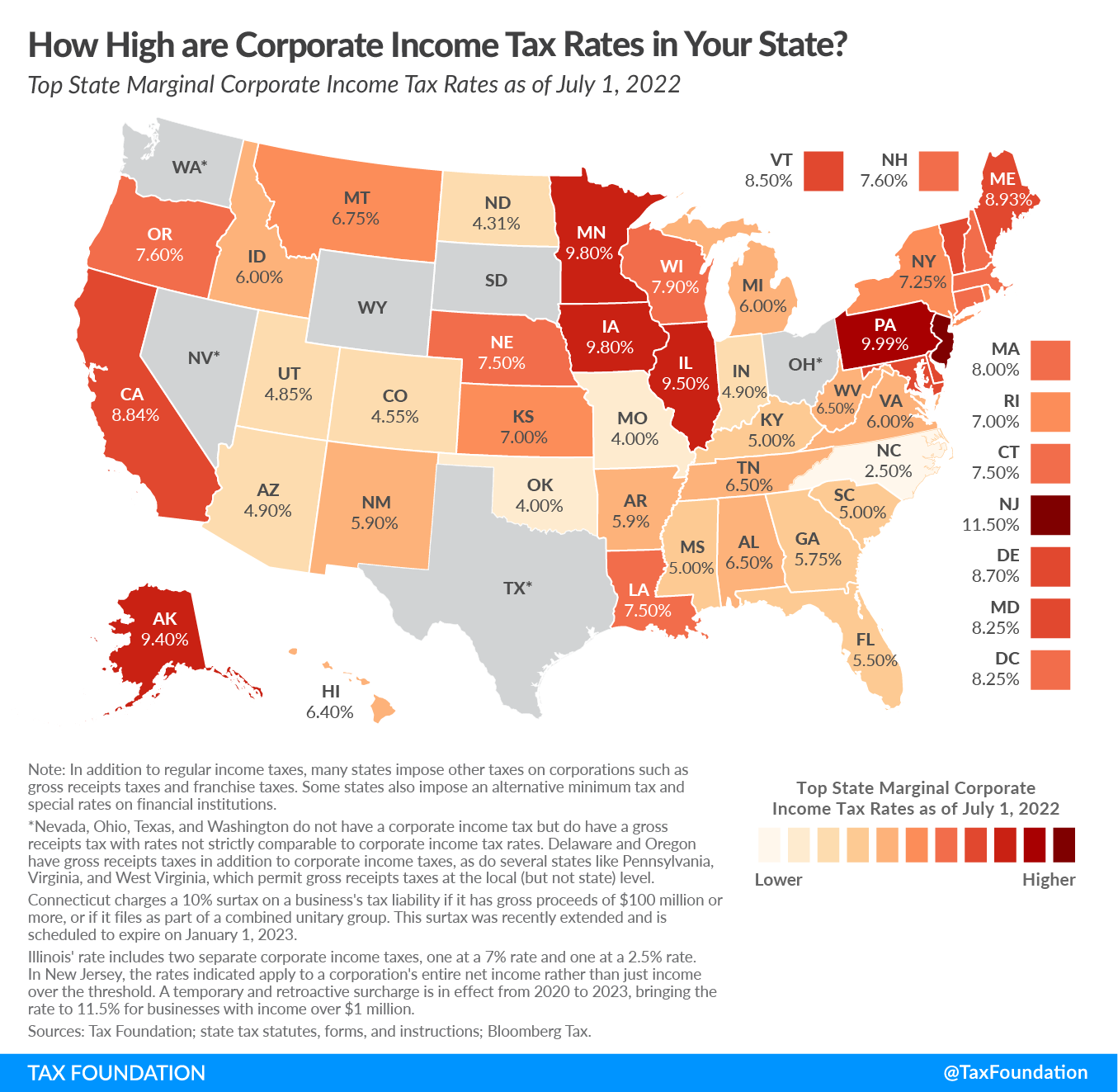

Search For Ms taxation With Us. Discover Helpful Information And Resources On Taxes From AARP. Mississippi also has a 400 to 500 percent corporate income tax rate.

File Your State And Federal Taxes With TurboTax. Single is the filing type used by all individual taxpayers who are not legally married and who have no dependants for whom they are monetarily responsible. STIMUlator - Recovery Rebate Credit.

The tax brackets are the same regardless of your filing status and. Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent. Unlike the Federal Income Tax Mississippis state income tax does not provide couples filing jointly with expanded income tax brackets.

Tate Reeves on Tuesday signed a bill that will reduce the state income tax over four years beginning in 2023. If you are receiving a refund PO. Box 23050 Jackson MS 39225-3050.

Mississippi Single Tax Brackets TY 2021 - 2022. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. 7 State Taxes 007 Average local tax 707 Combined Tax Property Taxes Property taxes are collected by local governments in Mississippi and are usually based on the value of the property.

Box 23058 Jackson MS 39225-3058. For single taxpayers living and working in the state of Mississippi. PAYucator - Paycheck W-4 Calculator.

There is no tax schedule for Mississippi income taxes. The graduated income tax rate is. 2019 Mississippi Tax Deduction Amounts.

These rates are the same for individuals and businesses. 2022 Tax Calculator Estimator - W-4-Pro. Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with.

See Why Were Americas 1 Tax Preparer. For married taxpayers living and working in the state of Mississippi. Mississippi Income Tax Brackets and Other Information.

W-4 Check - Paycheck Based W-4 Form. 2020 Mississippi Tax Deduction Amounts. Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. As fiscal year 2023 begins the 4 tax on an individuals first 4000 of taxable income will be eliminated entirely. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws.

Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay 3 For earnings between 500000 and 1000000 youll pay 4 plus 12000 For earnings over 1000000 youll pay 5 plus 32000. Notably Mississippi has the highest maximum marginal tax bracket in the United States.

RATEucator - Income Brackets Rates. Mississippi Income Tax Brackets. All other income tax returns P.

Mississippi Income Taxes. Your 2021 Tax Bracket To See Whats Been Adjusted. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Mississippis income tax brackets were last changed three years prior to 2019 for tax year 2016 and the tax rates have not been changed since at least 2001. Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 over 10000. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4 and 5 for Single Married Filing Jointly Married.

Andrew Joyce On Instagram Full Page Layout For Kiplingers Personal Finance Magazine Illustration Doodlesandstuff Andrewjoyce Illustrator Illustrated Drawing

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map Cost Of Living Infographic

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Mississippi Tax Rate H R Block

Pa Corporate Tax Cut Details Analysis Tax Foundation

The Best States For An Early Retirement Early Retirement Family Health Insurance Life Insurance For Seniors

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community

The Minimum Salary You Need To Be Happy In Every State

Which States Pay The Most Federal Taxes Moneyrates

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

These 7 U S States Have No Income Tax The Motley Fool

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Retirement

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Mississippi Tax Rate H R Block

The Steep Cost Of Medical Co Pays In Prison Puts Health At Risk

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map States